Dealing with roof damage can be a stressful experience, especially when it comes to the roof insurance claim process. Knowing how to navigate this procedure is crucial for homeowners looking to secure the necessary funds for repairs or replacements. In this article, we will cover the essential steps involved in filing a roof insurance claim, from recognizing the damage to working with your insurance company. By understanding the roof insurance claim process, you can ensure that your claim is handled efficiently and effectively, reducing the hassle and getting your roof back in shape as quickly as possible.

Assessing the Damage: The First Step

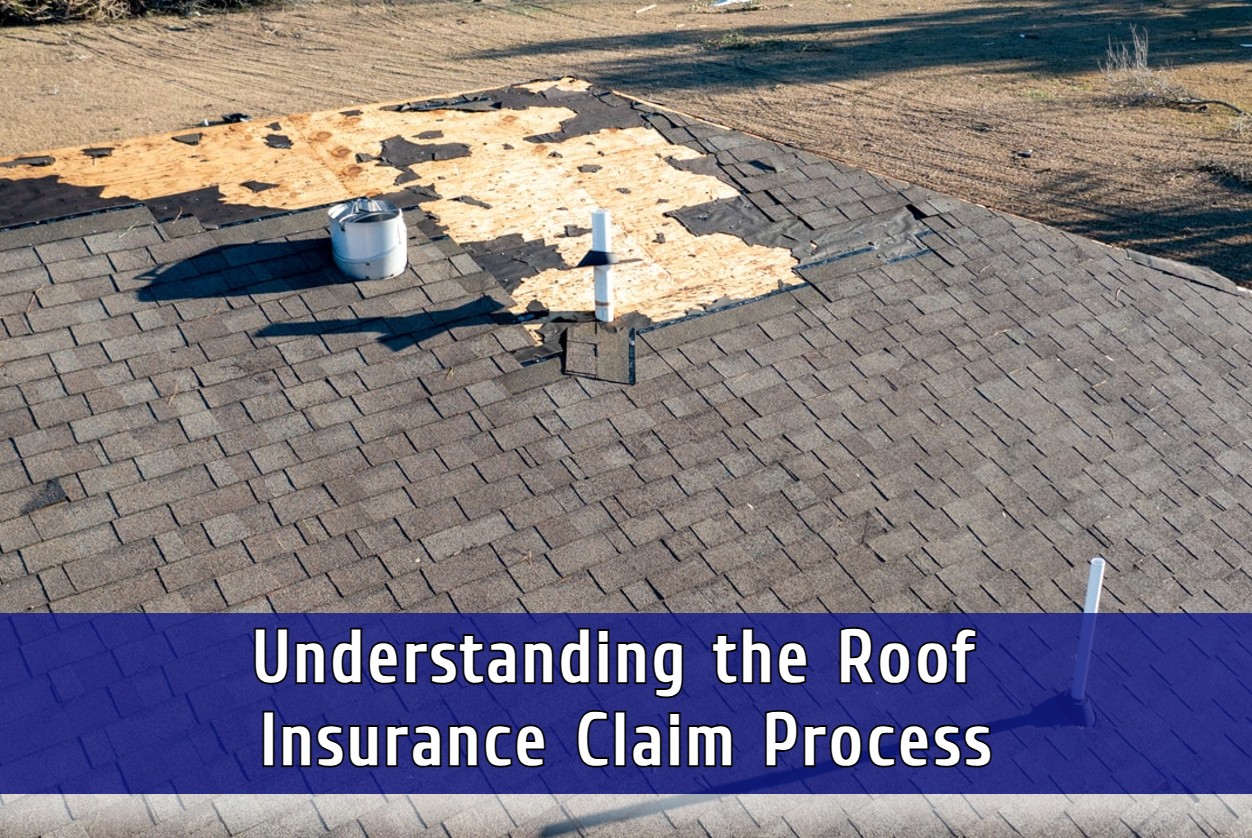

Before starting the roof insurance claim process, it’s crucial for homeowners to identify signs of roof damage. Look for missing or damaged shingles, leaks inside the home, and visible wear and tear. Checking the attic for water stains or mold can also reveal hidden problems. Noticing these signs early can prevent further damage and make the roof repair claim process smoother.

Documenting the damage is equally important. Take clear photos of all affected areas, both close-up and wide shots. Write down the date and specific details of the damage. This documentation will be essential when filing a roof insurance claim and can help support your case with the insurance company. Proper records ensure that your homeowner’s insurance roof coverage will efficiently address the necessary repairs or replacement as outlined in your insurance policy.

The Importance of Reviewing Your Insurance Policy

Understanding your roof damage insurance coverage is essential when dealing with the roof insurance claim process. Start by carefully reading your policy to know what is covered and what is not. Pay attention to specific terms related to roof repair claims, such as the types of damage covered and any exclusions that may apply. This knowledge will help you set realistic expectations for what coverage will be provided.

Key terms and conditions in your policy can significantly impact your claim. Look for details like deductibles, coverage limits, and any specific requirements for filing roof insurance claims. Knowing these terms will prepare you for any out of pocket expenses and help you understand the extent of your roof replacement insurance policy. By familiarizing yourself with these aspects, you can ensure a smoother and more informed claim process, ultimately leading to a timely and efficient resolution of your roofing issues.

The Main Event: Filing the Insurance Claim

There are several steps involved in filing a roof insurance claim. Start by contacting your insurance company to report the roof damage. Provide them with the documentation you have gathered, including photos and detailed notes. This helps establish the extent of the damage and supports your roof repair claim.

Next, fill out the necessary claim forms provided by your insurance company. Be thorough and accurate in your responses to avoid delays. Submit these forms along with any required paperwork, such as estimates from roofing contractors. Deadlines are crucial in this process, so make sure to adhere to all timeframes set by your insurer. Missing a deadline can result in a denied claim.

After submitting your claim, an insurance adjuster will likely visit your property to assess the damage. This step is vital for the approval of your homeowner’s insurance roof coverage, as inconsistencies can lead to denial. By following these steps and meeting all requirements, you can streamline the roof insurance claim process and secure the funds needed for your roof repairs or replacement.

Tips for a Successful Roof Repair Insurance Claim

Successfully navigating the roof insurance claim process can be challenging, but avoiding common mistakes and utilizing available resources can make it easier. Here are some tips to help ensure a smooth roof repair claim experience.

One of the most common mistakes homeowners make is not documenting the roof damage thoroughly. Always take clear photos and detailed notes of the damage as soon as it occurs. Failing to provide sufficient evidence can lead to delays or denials of your roof insurance claim. Additionally, missing deadlines for filing roof insurance claims can result in a denied claim, so be sure to adhere to all timeframes set by your insurer.

Another pitfall is not understanding your homeowner’s insurance roof coverage. Make sure to read your policy carefully to know what is covered and any specific requirements for filing a claim. Misunderstanding your coverage can lead to unrealistic expectations and potential financial shortfalls.

For additional support, consider reaching out to local roofing contractors in Central Ohio who have experience with roof damage insurance claims. They can provide valuable insights and assistance throughout the claim process. Additionally, many insurance companies offer resources and support for homeowners, including customer service hotlines and online claim tracking tools.

By avoiding these common mistakes and utilizing available resources, you can increase the chances of a successful roof repair insurance claim and ensure your roof is restored efficiently.

What to Expect When Working with an Insurance Adjuster

When dealing with the roof insurance claim process, one key step is the inspection by an insurance adjuster. During this assessment, you can expect a thorough examination of the damage. The adjuster will assess the extent of the roof damage and determine the necessary repairs or replacements. They will take notes, photos, and measurements to document their findings. It’s crucial to be present during this inspection to ensure that all areas of damage are accurately recorded.

Effective communication with the adjuster is essential for a smooth roof repair claim process. Be prepared to provide all the documentation you have gathered of the damage. Clearly explain any concerns or observations you have as this will help the adjuster understand the full scope of the issue and ensure that your homeowner’s insurance roof coverage is accurately applied. By maintaining open and clear communication, you can help facilitate a successful roof insurance claim and ensure that your roof replacement insurance policy addresses all necessary repairs.

Choosing a Roofing Contractor for Repairs

Finding a reliable roofing contractor in Central Ohio is essential when dealing with the roof insurance claim process. Start by asking for recommendations from friends, family, or neighbors who have had positive experiences with local contractors. Online reviews and ratings on sites like Google and Yelp can also provide valuable insights into the reputation and reliability of roofing companies.

Once you have a list of potential contractors, it’s important to ask them key questions to ensure they are the right fit for your roofing needs. Inquire about their experience with roof damage insurance claims and whether they can assist with the process. Ask for proof of licensing and insurance to make sure they are qualified and covered for any potential accidents. It’s also wise to request references from past clients to get a sense of their work quality and customer satisfaction.

Discuss the specifics of your homeowner’s insurance roof coverage with the contractor to ensure they understand your policy requirements. This will help you avoid any misunderstandings or issues during the repair or replacement process. By taking these steps, you can confidently choose a roofing contractor who will help you navigate the roof insurance claim process and restore your roof effectively.

Expert Roofing Assistance in Central Ohio

AM Roofing & Siding is your trusted partner in navigating the roof insurance claim process. Our experienced team understands the complexities of assessing roof damage, reviewing insurance policies, and filing claims. Don’t let uncertainty delay your repair – call (740) 974-8268 today for expert guidance and support. We’ll ensure you receive the coverage you deserve and guide you through every step of the process. Trust AM Roofing & Siding for a smooth and successful roof insurance claim experience.